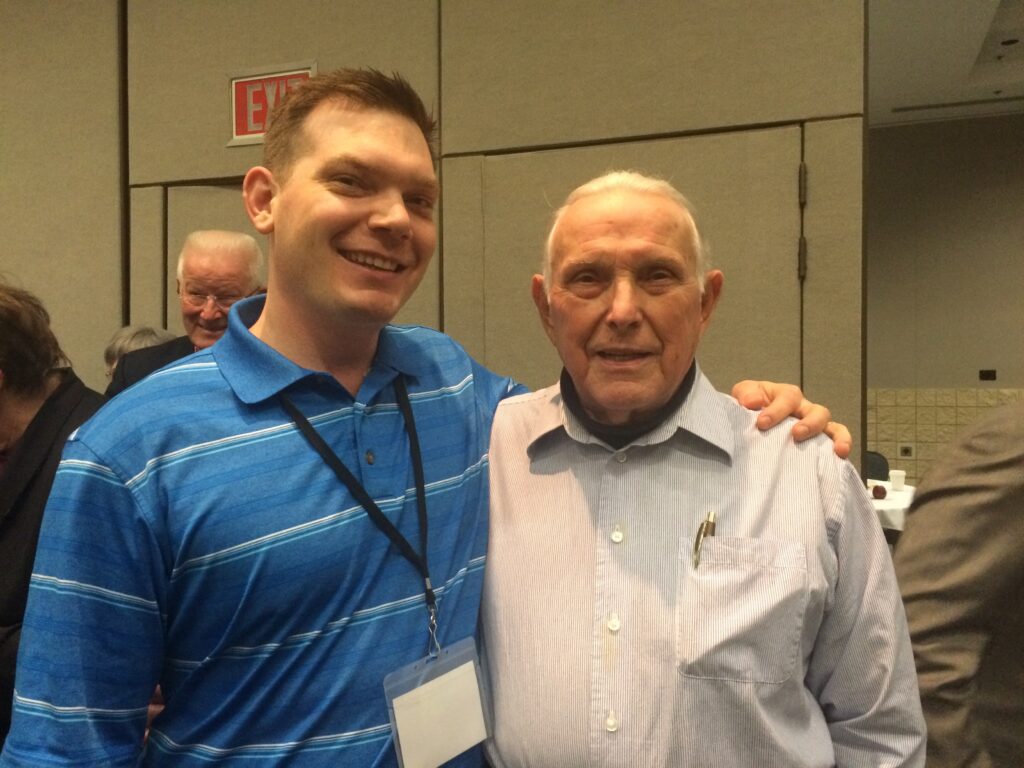

I began practicing the Infinite Banking Concept in 2009 after reading Becoming Your Own Banker by the late R. Nelson Nash. That book “lifted the fog” for me — it showed me where money was flowing in my life and how much of that flow I had handed over to someone else. Over time, Nelson became a close friend and mentor. I still remember him telling me, “You’re a genius at teaching this,” and trusting me to emcee the Nelson Nash Institute Think Tank. That experience shaped how I teach and live this process today.

For me, Infinite Banking is part of everyday life. I’ve used it through all kinds of market conditions and have helped hundreds of Canadians put it to work in their own situations. These are the questions I hear most often, along with lessons, stories, and examples from my journey.

Q1: What Is Infinite Banking?

I explained this in detail when I was hosted by Caleb Guilliams on his BetterWealth podcast. Infinite Banking is a way of managing the movement of money in your life using dividend-paying whole life insurance. Nelson described banking as an action — money moves from one place to another in everyone’s life, every day. The aim is to be in the control position for as much of that movement as possible.

A properly structured policy lets you access the cash value through policy loans. This can fund purchases, investments, or business needs, all while the cash value continues to grow. Nelson taught that control is regained “slowly and incrementally,” and I’ve seen that happen time and again.

One client had been building his system for years before the oil market crash. When banks pulled back on lending, he didn’t need their approval. He used his policy’s cash value to keep his business running, avoiding delays and uncertainty.

Q2: What guarantees come with these policies?

With a dividend-paying whole life policy:

-

Premiums stay level for life.

-

The original death benefit is guaranteed.

-

Once declared, dividends are guaranteed to be paid.

The cash value and death benefit increase together. With the right design and consistent behavior, this growth can be significant. I treat my premiums as a form of forced savings — my own built-in pay yourself first system — much like the principle in The Richest Man in Babylon.

Q3: Are there other names for Infinite Banking?

Nelson called it “Becoming Your Own Banker.” Over the years, other terms such as “cashflow banking” or “bank on yourself” have appeared. While the names change, the process remains the same. Before Nelson’s work, policy loans existed, but very few people viewed them as the foundation for a complete personal financing system.

Q4: What happens to my cash value when I pass away?

The cash value is part of the death benefit. For example, if a policy has $100,000 in cash value and a $500,000 death benefit, the full $500,000 is paid to the beneficiaries. The insurance company doesn’t keep the cash value — it’s part of the property you own under contract.

Q5: How much can I borrow, and how quickly can I get the funds?

Most insurers allow loans of up to 90% of the available cash value. Depending on the company, the money can be in your account within days. I’ve used policy loans myself to act quickly on opportunities, and I’ve helped clients do the same for real estate purchases and urgent financial needs.

Thinking Beyond Your Lifetime

Nelson taught me to think beyond my own lifespan. I often ask people, “Are you thinking beyond your own lifetime?” That question alone can change the way you make decisions.

When Nelson passed away, he had 45 policies in place. Seventeen paid out immediately to his beneficiaries. The rest stayed in force, providing liquidity and growth for his family long after he was gone. He financed vehicles, three airplanes, and multiple investments entirely through his system, living more than 25 years without relying on a traditional bank loan.

Why Behavior Matters Most

A policy is a tool — and like a chainsaw, it can be highly effective or completely wasted depending on how it’s used. I’ve met people who bought a policy but never changed their habits, which means they weren’t actually practicing Infinite Banking.

Others have made the right behavioral shift. One example is a client who redirected the $1,000 a month he had been sending to Visa back into his own system after paying off the card. Over time, that choice built a large capital pool that he could use again and again. As I often say, “You cannot generate wealth through consumption.” Wealth is built by saving consistently, keeping money in motion under your control, and making disciplined repayment part of your process.

Protecting Your Family

One of the hardest calls I’ve made is telling a parent their child can’t be insured. Health trends and underwriting changes mean this is happening more often. That’s why I remind people, “You don’t know your best insurability date.” Securing coverage early can protect your family and set the next generation up with a valuable financial tool they can use for life.

Final Thoughts

Infinite Banking is Austrian economics in action at the individual level — it’s about control, liquidity, and creating a financial life that runs on your terms. I’ve lived it for years, and I’ve seen it transform the lives of those who commit to it.

For a deeper look at the process, I co-wrote a book that walks through the steps in detail.